Are you in the market for a new automobile? Perhaps you spent Black Friday auto shopping. Yes, people really do go car shopping on Black Friday. In fact, The Nashville Ledger published a “how to” article on November 24, 2017, “How to shop for car deals on Black Friday.” Part of their step-by-step instructions included this caution: Bring along a copy of your current auto insurance card. But you may be surprised to learn that the new high-tech autos add to higher auto insurance rates.

We all realize the average price of a new automobile in the United States is not inexpensive and the majority have hi-tech features. But in early November Kelley Blue Book spelled out some hard numbers in a press release:

“The analysts at Kelley Blue Book last week reported the estimated average transaction price (ATP) for light vehicles in the United States was $35,263 in October 2017. New-car prices have increased by $101(up 0.3 percent) from October 2016, while climbing $128 (up 0.4 percent) from last month.”

Why does high-tech equal higher insurance rates?

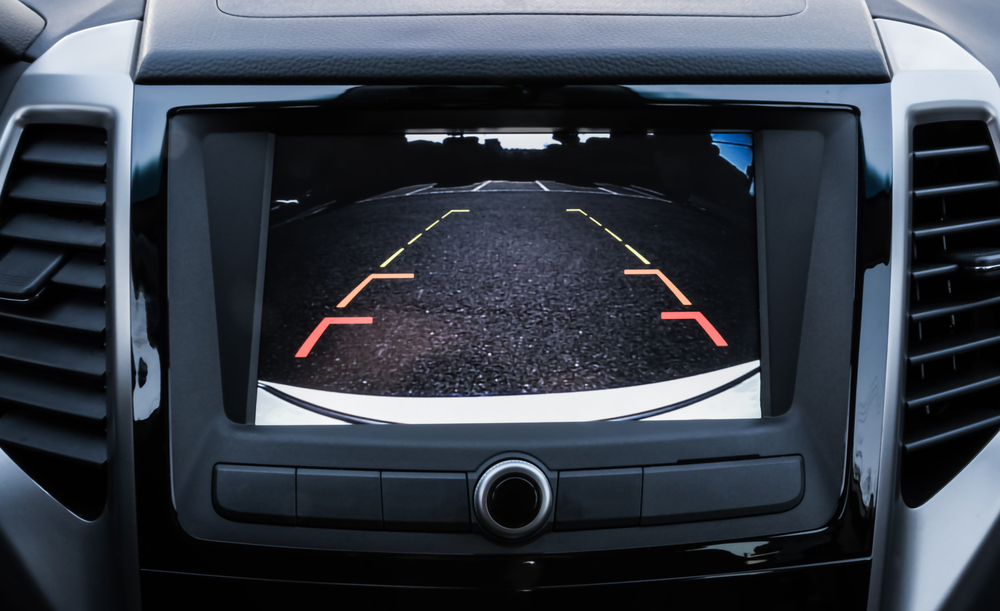

Certainly, there are more cars on the road and the cost of injury claims have increased due to the high price of medical treatment. However, when viewing television commercials, it is not unusual to be taken in by the technology: high-tech monitors, rear-view cameras, side cameras, cruise control for all speeds (even local driving), lane change alerts, and yes, even voice commands to operate your phone, send text messages and map navigation. The list is endless and when computer operated features need to be repaired the price is high.

In late October 2017, CBS New York covered this story-line and interviewed the Insurance Information Institute’s (III) California representative Janet Ruiz. Ms. Ruiz sums it up this way: “Fixing the cars with all the new technology can be more expensive.”

Consumers can be proactive about higher auto insurance rates

Since 1946 John Bailey Company has offered our clients comprehensive auto insurance. As an independent agency, we can shop our stable “A Rated” auto insurance carriers. But we encourage our clients to be proactive when reviewing their auto insurance policy renewal, particularly when purchasing a new high-tech vehicle. Here are a few items to discuss with your agent.

- 55 or over? Ask if there is a course to take which allows for a discount on your auto insurance

- High school students in your household? Ask about a good student discount

- Ask if your insurance carrier offers a device to install in your car which monitors your driving habits

- Ask about low mileage discounts

- Ask if any life changing events can positively impact your premium

- Ask about bundling your auto insurance with your homeowners or renter’s insurance

Remember, take your time. If you buy a new automobile, consider your car purchase carefully and let our John Bailey Company team create insurance solutions for you and your family. Enjoy the ride!